Across the greater Upper Valley region (region), many communities share the same challenges to providing safe, comfortable, and affordable homes. Other challenges are more pronounced among either larger or smaller communities. Working together provides us with greater opportunities to meet these challenges.

As a region, our vacancy rate hovers around 2% or less, signifying a high demand market and driving up costs. A healthy vacancy rate is considered to be between 4 to 5%. During the COVID-19 pandemic, preliminary data suggests that homes are selling rapidly and that the supply of homes on the market has shrunk even further.

Also highlighted by the COVID-19 pandemic, our region must do better for our homeless population and those in need of homes with supportive services, as detailed in the Emergency Housing and Homes with Supportive Services report. Homes with supportive services provide a safe home, transitional or permanent, in conjunction with needed services (such as vocational training, mental health care, addiction services, life skills services). These homes may exist in a permanent location or be available for any household deemed in need. In our public survey, 55% of residents agreed that homes with supportive services were needed, with only 10% disagreeing. Despite this public support, providers identify multiple barriers to expansion from funding to infrastructure access to neighborhood reluctance. To address this specific shortfall, the region will need creative strategies.

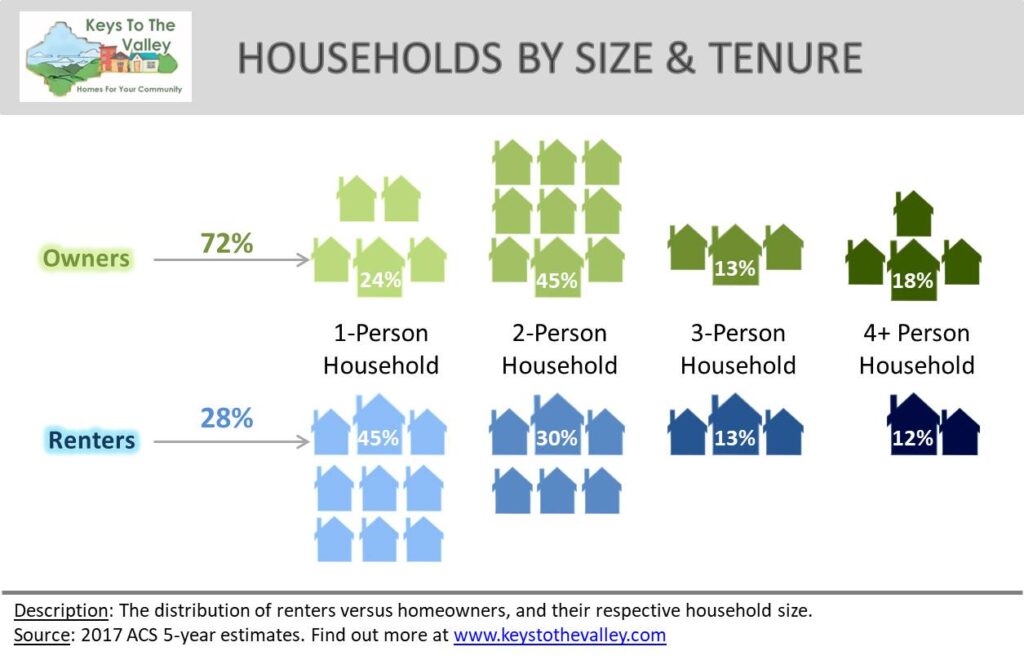

Of the near 70,000 households in the region, nearly three-quarters (72%) own their homes. The remaining 28% of households are rentals; however, there are significant variations among communities. Renters make up one-third (33%) of households in larger communities and less than one-fifth (18%) in smaller. As detailed in the Costs of Homes section, renters are more cost-burdened than homeowners, meaning they pay a higher proportion of their income on housing and transportation costs. Ensuring an adequate supply of affordable rental options, including small homes and apartments will be vital to meeting our housing challenges.

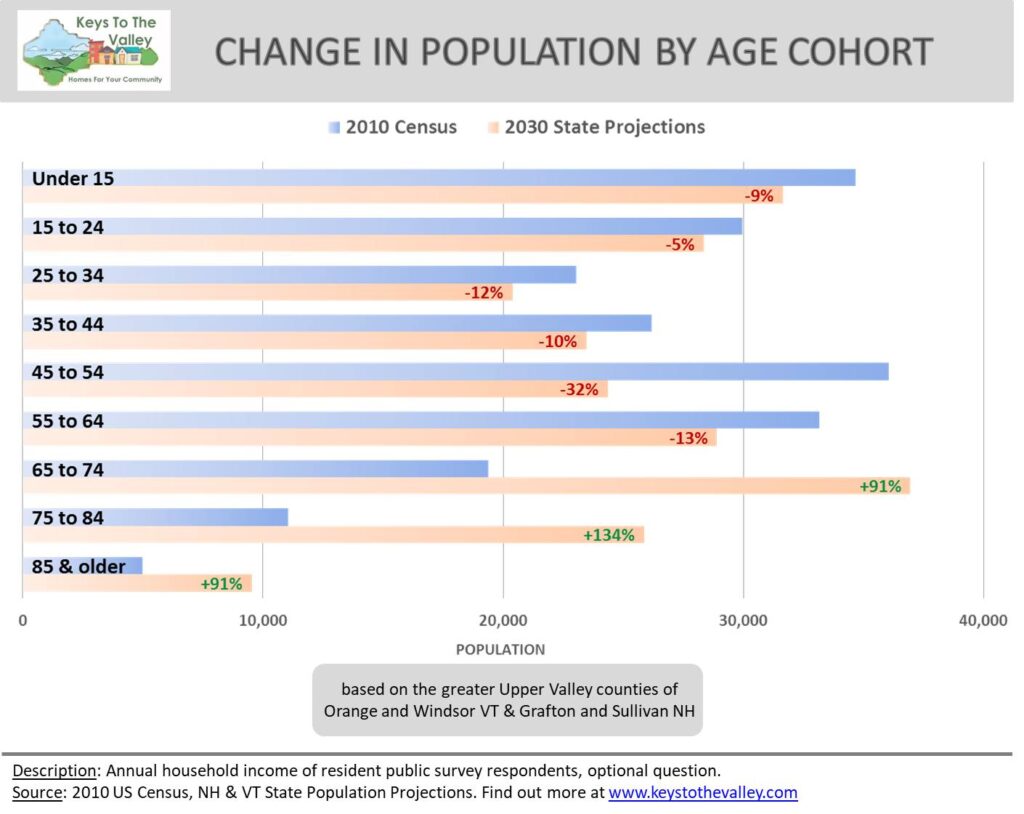

In general, renters tend to live in smaller groups than homeowners (Figure 3). Single renters tend to live in the region’s larger communities, while renters in families of four or more live in the smaller communities. Across our region, household sizes have been shrinking, a trend expected to continue. Although our young people influence the trend by maintaining smaller families compared to previous generations, the trend is largely driven by an aging population who tend to occupy smaller homes. Figure 4 illustrates this population shift based on 2010 census to 2030 state projections, showing significant population increases for people above 65, and milder decreases for those younger than 65. Our aging population and related shrinking household demonstrate that large, single-family homes increasingly do not address the needs of our region. See the Keys to the Valley 2030 Homes Projections Memo for full details on how changes in population age cohorts impact our shrinking household. Shrinking households is a national trend, with one or two person households becoming more the norm. Simultaneously homes with more bedrooms, three or more, are being developed at a faster rate (Attainable Housing: Challenges, Perceptions, and Solutions by Urban Land Institute).

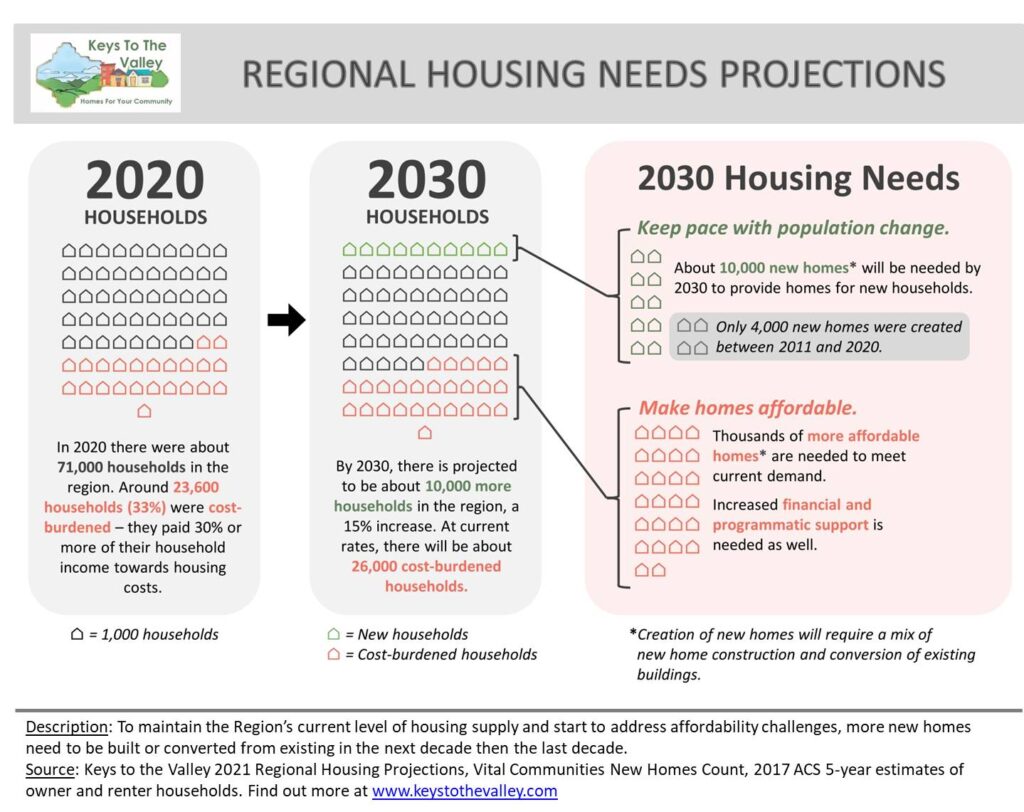

Vital Communities has tracked new homes, both new construction and conversions of existing structures, for 27 of the communities in the region, including all of the region’s larger communities. It was found that the number of new homes added over the last decade is roughly 2,400, of which 1,600 homes are located in larger communities. Applying the appropriate rate to the remaining 40 smaller communities in the region, we estimate that an additional 1,500 homes were built over the last decade, for an estimated total of 3,900 new homes.

Renters and homeowners are not the only ones living in our region. Tracking populations of second homeowners is difficult, but we do know that a considerable number of homes, 18% in the region, are dedicated to seasonal or recreational use (Figure 5). In communities closer to ski resorts and large lakes, the proportion can be even higher; sometimes half or more of all homes are seasonal. Despite stagnant or shrinking populations across much of the region, the demand for seasonal and recreational housing continues to drive development. Furthermore, seasonal residents may have different priorities when searching for a second home than year-round residents. Homes built for our seasonal residents are unlikely, then, to address the housing shortage in the region. It is not yet clear to what extent COVID-19 has led to the transformation of seasonal homes into full-time residences nor how permanent this trend will be.

Using a household projection model, which is based on population growth by age and ownership (I.e., renter or homeowner), we estimate that approximately 10,000 new homes of all kinds will be needed by 2030 in order to meet increased demands and maintain current household supply levels. In addition, more homes will be needed to address the region’s housing supply and affordability challenges, already in crisis (Figure 6). In order to maintain current trends, almost every community is projected to have a need for new homes. This baseline need for homes corresponds to a projected increase of 10,000 new residents. This does not mean new residents will all be solo-living, but rather the average household size will be smaller, mainly due to an aging population. Despite this slight decrease, the average home will continue to host more than two people. Almost 85% of these new homes are projected to be occupied by homeowners, with the remaining 15% by renters. See the Keys to the Valley 2030 Homes Projections Memo for full details and results by town.