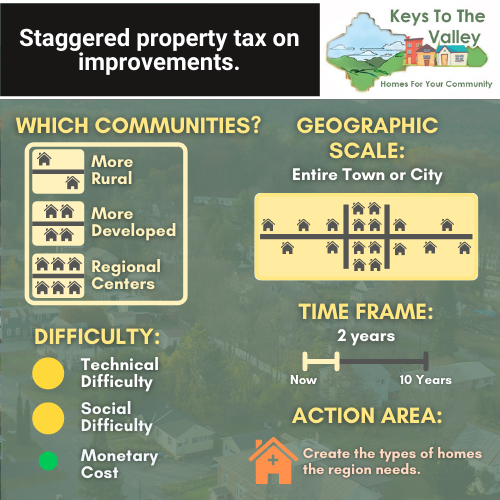

Both owned and rental properties could benefit from investment that improves accessibility, creates accessory dwelling units, reduces mold and lead, provides modest improvements in quality of condition, and reduces energy costs. However, these improvements can immediately increase the value of the structure and thus increase annual property taxes, at the same time when the owner has just spent funds on the improvements. Rather, taxes on the increase in value could be staggered so that their full value is not taxed right away but ramps up over time (5-10 years). This could be done at the state level or enabled as an opt-out local option for municipalities that provide other affordability incentives and rely on increased property tax from such improvements to fund them. Care also has to be taken to structure such relief so that incentives do not simply subsidize creation of short-term rentals and ‘flipping’ properties.